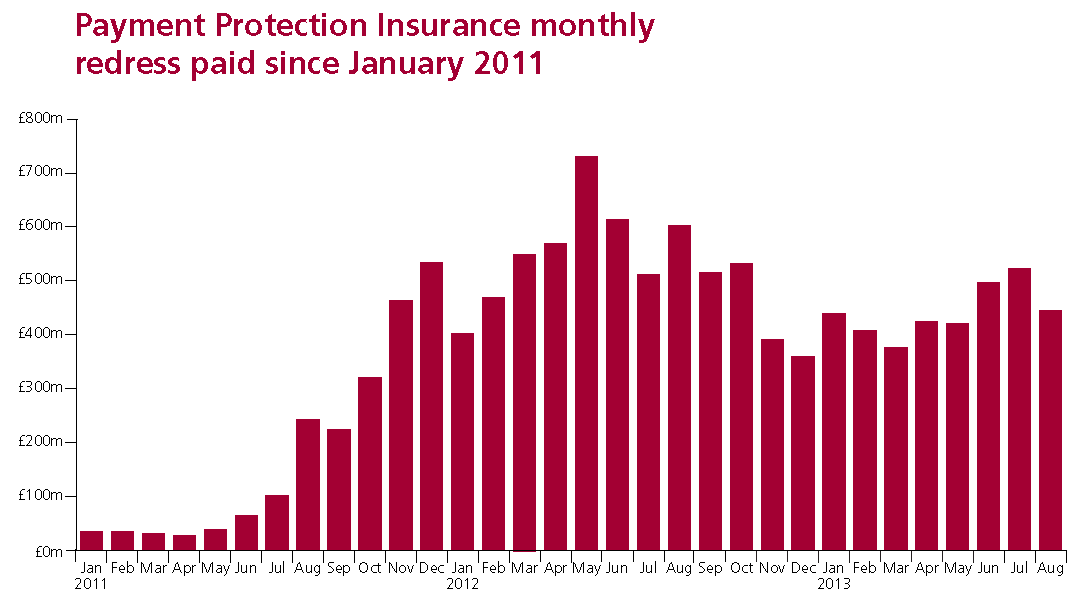

The latest figures from the Financial Conduct Authority (FCA) show the current cost paid out to customers in relation to mis -selling payment protection insurance has hit £12 BILLION.

(Source – Financial Conduct Authority)

The PPI mis-selling scandal showed no signs of decreasing in the first half of 2013 which drove complaints to a record high. The number of complaints received by the Financial Ombudsman Service went up by 140% in just one year, up to 3000 complaints a day at its peak.

In July 2013, £528 million was paid back to customers who complained about the way they were mis-sold payment protection insurance (PPI). Jumping to August, figures dwindled slightly but banks still paid out a whopping £446m.

The course of the year has surpassed all expectations with banks being fined on a monthly basis which generated a continuous rise to the amount paid back to clients.

“Disappointingly we are still seeing cases where businesses are not following our long-standing approach to PPI, resulting in long waits and unnecessary delays for consumers,” said Natalie Ceeney, the Chief Ombudsman.

The Financial Conduct Authority (FCA) collated its figures from the 24 firms responsible for 96% of mis-sold PPI complaints last year, with the final industry-wide bill expected to exceed the current amount.