Claiming compensation for those extremely annoying delays or cancellations can seem like a chore and lots of people don’t bother. In fact, two-thirds of passengers don’t claim for their train delays. That’s a lot of money people are missing out on.

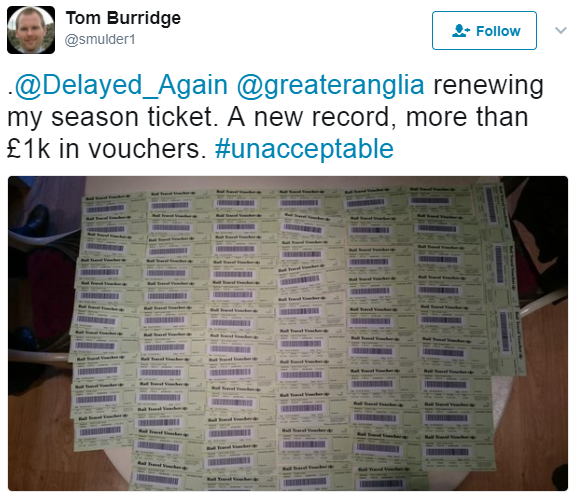

Trust us, it’s worth making those claims. Andy Young travels from his home in Hertfordshire to London’s City Thameslink every day and he makes between £230 and £330 each year in compensation. Similarly, Tom Burridge claimed over £1k compensation in train vouchers:

If you don’t remember the length of the delay, then take a look at the Recent Train Times website. You just need to add in the train stations you were travelling between and the dates and it will tell you the actual arrival times.

It’s important to note that each train company has a slightly different repay policy. And so you don’t have to trawl through their website looking for it, we’ve created a go-to list of minimum delay times in order for you to receive compensation, the amount you could be refunded for a single journey and links to each company’s delay repay page.

Don’t let the train companies hold on to your compensation. Follow our guide, use the links below and get back your cash!

| Link to train company’s delay repay page | Minimum delay time for compensation | Amount you could be refunded on a single journey |

| Arriva | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| C2C | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| Caledonian Sleeper | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| Chiltern Railways | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| Cross Country | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| East Midlands Trains | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| Gatwick Express | 15 minutes | Delayed 15-29 mins? 25% of the ticket price. Delayed 30-59 mins? 50% of the ticket price. Delayed 60-119 mins? 100%. |

| Grand Central | 60 minutes | Delayed 60-120 mins? 50% of the fare back. 120-180 mins? 75% back. More than 180 mins? 100%. |

| Great Northern | 15 minutes | Delayed 15-29 mins? 25% of the ticket price. Delayed 30-59 mins? 50% of the ticket price. Delayed 60-119 mins? 100%. |

| Great Western Railway – High Speed | 60 minutes | Delayed 60-119 mins? 100% of the fare back. |

| Great Western Railway – London & Thames Valley | 30 minutes | You get 50% of the fare back if you’re delayed by more than 30 minutes (on journeys of less than an hour) or if you’re delayed by an hour or more (if your journey is an hour or more). |

| Great Western Railway – South Coast | 60 minutes | Delayed 60-119 mins? You’ll get 50% of the fare back. More than 120 mins? 100%. |

| Greater Anglia | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| Hull Trains | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| London Midland | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| Merseyrail | 30 minutes | Delayed more than 30 mins? 100% of your fare back. |

| Northern | 30 minutes | Delayed 30-59 mins? 50% of your fare back or one free single ticket to anywhere on the network. 60+ mins? You’ll get 100% back or two single tickets. |

| ScotRail | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| South West Trains | 60 minutes | Delayed more than 60 mins? 100% of your fare back. |

| Southeastern | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| Southern | 15 minutes | Delayed 15-29 mins? 25% of the fare. 30-59 mins? 50% of the fare paid. More than 60 mins? 100%. |

| Stansted Express | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| Transport for London | 30 minutes | Delayed more than 30 mins? You’ll get a refund for a single journey. More than 60 minutes? 50% of the fare (if higher than the single journey refund). |

| ThamesLink | 15 minutes | Delayed 15-29 mins? 25% of the ticket price. Delayed 30-59 mins? 50% of the ticket price. Delayed 60-119 mins? 100%. |

| Transpennine Express | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| Virgin Trains | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

| Virgin Trains East Coast | 30 minutes | Delayed 30-59 mins? 50% of ticket price. More than 60 mins? 100%. |

Back in November the country’s Chancellor, Phillip Hammond, conducted the last ever Autumn Statement. Covering a broad range of subjects, one particular suggestion pricked the ears of tenants all over the country: a ban on letting agent fees.

Tenants are all too aware of the huge costs letting agents charge. Credit checks, contract fees, check in fees, check out fees, and many others with vague titles. You can even get charged over £100 for a contract to be renewed, a process involving pressing print, a stapler, and a pen.

So, when is the letting agent fee ban coming into effect?

Not just yet. First, the Government needs to conduct a consultation. This was announced to take place in March/April of this year. Then in February, they released a housing a white paper which again mentioned a ban on fees.

Eventually the consultation was opened on 7th April. It’s currently still open and will close on the 2 June 2017. You can respond yourself here. Along with talking to tenants, the consultation will also include talks with landlords, Citizens Advice, and the Which? consumer group.

Based off this the Government will make its decisions, with landlords hoping the idea will be scrapped and tenants hoping the endless rip off charges will be culled. Although there’s been some concern among renters that the snap election could mean the ban will be forgotten (or quietly buried) after June 8th.

Meanwhile the landlords have asked for the consultation period to be extended. They say it should take place after the election and have sent a letter to the government about it. They claim that because of the election the ban will become a manifesto pledge, which means the consultation may break the purdah rules – purdah being the time between an election announcement and the election where the government cannot announce new laws.

Nevertheless, the Tories have included the ban in their manifesto, saying that they will “shortly ban letting agent fees.” There’s no further details beyond that, but it seems a ban is becoming an inevitability, especially as the Liberal Democrats and Labour have committed to it as well.

So it looks like good news for current and future tenants. Let’s just hope the ban comes in sooner rather than later.

In the meantime, if you’re faced with massive fees before the ban, there are some options. First, if possible, try to rent from landlords directly as they’re unlikely to charge these kinds of fees. Websites like Gumtree, Loot, and Spare Room can be a good place to start. Post on your Facebook and Twitter too in case a friend knows of a place going.

It’s also worth trying to negotiate with the letting agent. If you’re lucky they might let you off some fees. In the end though, if they want to charge them, they will.

Update

Since this piece went live the Conservatives have announced a bill that will ban letting agent fees. At the moment they still need to get their Queen’s Speech passed, but if they do so, then the letting agents fee bill will most certainly pass as all parties support it. There’s no timetable as of yet, especially considering the very fluid nature of UK politics at the moment.

...

We understand how frustrating cold calls are, which is why we will never ring you unsolicited. However, most companies – for PPI refunds and otherwise – don’t share our mindset. We’re sure you’re often answering the phone to strangers who refuse to tell you where they got your number.

Next time, instead of getting angry or even calmly hanging up, why not take inspiration from these pranksters and waste their time? We’ve also explained before about how to claim compensation from cold calling companies too.

We’ve compiled ten of our favourite funny cold call videos (yes, there is such a thing). We hope you find these as amusing as we do. Have a wind-up story of your own? Let us know in the comment section below.

Russ McCulloch mashed up two prank call classics – the takeaway order and revenge on the cold caller. Our personal highlight is the naïve telemarketer mistaking Russ’s ramblings about a chopstick for him saying he’s off sick but there are plenty more laughs to be had here too.

David Borthwick has been phoned by a PPI company he has never contacted before. But who gave them his number? Was it Auntie Jean or Uncle Freddy?

This classic from mediocrefilms2 shows how to ruin a telemarketer call in an extremely friendly way. It’s how you imagine Buddy the Elf answering a cold call. And no, he doesn’t ask for the caller’s favourite colour.

Normally cold callers being pranked are unamused but this debt advisor joins in on the fun and laughs along with Larry Millar. Never has a cold caller been so easy to warm to.

An oldie but a goldie, this Videojug upload features a man who is very happy to say to yes to this telemarketer’s requests – he just doesn’t want to say anything else. Literally.

Grime MC Jme received an unsolicited PPI refund call. So he did what came naturally to him, and after 10 minutes on the phone, he performed to his call centre audience.

This 3-year-old has learnt the art of dismissing cold calls from a very early age in this short but sweet video by Clare Glenn.

Robbie Britton found that telemarketers find fellow cold callers just as annoying as we do. When two contacted him at the same time, he conducted a three-way conversation.

Lynn Napier shared this dead pan cold call response with the world last year. You certainly need patience to put up with unwanted calls. Or should that be patients?

It’s not just YouTubers who find humour in cold calling, it’s also become part of comedian’s stand-up routines. Lee Mack took to the stage of the Apollo about his response to an energy company.

As frustrating as cold calling may be, we hope this round up has helped ease some of your pain. So, try and have a laugh the next time you receive an unsolicited call. Whoever the call is from, you can guarantee that it won’t be from us.

...

As is well documented, the Financial Conduct Authority (FCA) has proven its weakness once more by allowing a PPI deadline to be introduced.

Whilst this is being challenged through the courts as it clearly only benefits the banks, there was perhaps a greater scandal hidden in the news.

The news surrounds the hidden commission payments received by the banks for selling PPI to consumers.

In 2014 the Supreme Court ruled that a customer be awarded compensation due to a lender failing to provide information surrounding PPI commission payments.

The customer was sold a PPI policy for £5,780 by the lender, Paragon Finance, who also loaned the customer £34,000 as part of the deal.

The PPI provider, Norwich Union, took £1,630 of the £5,780 by way of payment for the PPI policy sold to the customer on its behalf by Paragon Finance.

The remaining £4,150 was retained as a commission by Paragon Finance and a secondary introducer.

That is a staggering 71.8% PPI commission!

Quite rightly, the Supreme Court ruled that failing to disclose this commission to the customer resulted in an unfair relationship.

Furthermore it culminated in the customer being denied crucial information in order for her to make an informed decision regarding the value for money of the product she was purchasing.

I think it is fair to assume that any customer would reject such a policy had they been made aware over 70% was pure commission.

The customer was quite rightly awarded £4,500 compensation.

Firstly it is important to state what the primary and overriding duty of a regulator is.

A regulator is to protect consumers by ensuring those it regulates operates in a fair and responsible manner.

A regulator is NOT there to protect the financial position of those it regulates.

You’d be forgiven for thinking that is not the case when it comes to the FCA, who have consistently been at the whim of the banking sector.

The Supreme Court Ruling was issued on 12th November 2014.

However, the FCA have taken almost 30 months to issue new rules for banks to follow when dealing with complaints involving PPI commission payments.

You may need to sit down if you are not already, when we tell you what the FCA consider to be a fair amount of commission.

Firstly, the court awarded the customer £4,500 compensation which is above and beyond the £4,150 commission payments that were involved.

The FCA have concluded that 50% commission is fair!!!

Yes, the FCA have concluded that 50% commission is fair!!!

Is there any other industry where the regulator deems 50% commission to be fair if it has not been disclosed to a consumer?

This ruling clear conflicts the ruling of the Supreme Court, and is yet another in a long line of examples of the FCA trying to protect the banks.

Had the FCA had their way the customer would have only received £1,260 compensation.

This is clearly a matter for the consumer to decide, not the FCA.

The Supreme Court ruled that because the customer was not advised of the commissions involved she was denied the information required to make an informed decision.

In other words, the PPI policy was mis-sold plain and simple.

Your Money Claim believe that if the customer was denied the information then a 100% refund should be due, and this is what we will be fighting for.

Much like the introduction of an unfair PPI deadline, it is clear that this will be challenged through the courts.

The FCA and the banking sector will make every attempt to sweep this under the carpet in order to protect their own interests.

There have been so many opportunities for the FCA and banking sector to put things right but it looks like the fight will have to go on.

...

There’s a huge array of methods con artists use to try and trick people out of their hard-earned money. We take a look at some of the more commons ones so you don’t get sucked in.

An email from your bank pops up in your inbox. It looks just the same as all the others you receive from. There’s a problem it says. It asks you to click a link and on the page it loads, which also looks like your bank’s website, you’re asked for your sort code, account number, and security code. You enter the details and you’re told the problem is solved.

The only thing is that the next time you check your account all of your cash is gone, either spent or simply transferred out. The email you received was a scam, where con artists replicate a bank’s email and site styles to trick people into handing over information.

There’s a simple way to protect yourself here. Your bank is never going to ask you to verify sensitive information straight from a link in an email. If you don’t have to go through your usual online banking log in process, it isn’t genuine.

If you’re ever concerned about an email, just call your bank instead. They’ll be able to let you know if the email is real or not.

When these scams first started to appear they usually originated in Nigeria, hence the name. The 419 references the section of the country’s criminal code that prohibits the scam. So what is it?

Essentially you’ll receive some kind of plea for help that involves large sums of money that are set to be taxed heavily in the country the sender resides in. They ask if you’d be willing to have the money transferred to you in exchange for a generous percentage. In other words, the chance at millions of pounds for doing nothing.

Of course there is no money. What the scammer wants is your bank details, which they claim will be used to send you the imaginary money. You can probably guess the next step. The scammer clears out the target’s bank account and disappears into the ether.

With these kinds of cons always ask yourself: is this too good to be true? A Nigerian prince probably has better ways to avoid tax than enlisting the help of Steve in Maidenhead. If you receive any kind of request remotely similar to the above, delete the email and forget about it.

With the NHS being severely hit by this scam recently, it’s important to keep a watchful eye out. Ransomware is when a piece of software gets onto your PC and essentially locks everything down. The software then demands a payment to release your computer and your files. Unfortunately this isn’t an easy thing to get rid off once you’ve got it.

Prevention is the key here. Make sure your PC is always up-to-date as older version often have security issues that hackers take advantage of. Next get some decent security software to protect yourself too. Finally, ensure System Restore is turned on (here’s a step-by-step guide). This means if your computer is taken over you can restore the restore your PC to a time before the ransomware took over and stop yourself losing all your files.

While the name for this con only came about after the 2010 film Catfish, the scam has existed for as long as the internet has connected strangers together. The perpetrator pretends to be someone they’re not, often faking a romantic interest in the victim and stringing them along.

While not all cases involve requests of money, a significant amount do. Usually a fake story is used to illicit sympathy and then cash. Throughout all of this the con artist will use any excuse not to meet the victim in real life or offer up proof of their identity. Unfortunately there are many victims who accept these excuses.

Avoiding these scams is straightforward. If you’re ever getting close to someone online – particularly if they come out with financial sob stories – ensure they prove who they really are. On a separate safety note, if you ever meet someone from the internet always tell people where and when you are going and never go alone.

For as long as there’s been doorsteps there’s been doorstep scammers. There’s a huge range of types, but essentially they boil down to someone knocking at your door and pretending to be someone they’re not.

They may pretend they’re collecting for a charity, or they could be trying to sell you something you don’t need or that won’t ever materialise. Another common one is people pretending to be come kind of official, such as from the council or your electricity company.

Never let anyone in our house if you’re not 100% sure. Anyone official should have ID on them to prove who they are. Give the company or organisation a call to check, but be sure to get the number yourself if you can to be sure it’s correct. Never hand over things like your PIN number to people, or hand over cash either.

If in doubt, ask whoever it is to leave and call someone you trust.

Finally, if you think you’ve been a victim of a scam money.co.uk has a great piece on what to do next here.

...

It’s always nice to help save the world at the same time as saving yourself some money. A win-win all round. Below you can find some tips to make your driving more efficient and environmentally-friendly, and therefore better for your bank balance.

Before you even set off on your journey, there’s a few things you can do to save some fuel.

The heavier your car the more fuel you’ll use up. That’s no surprise, but we can have habit of letting things pile up on the backseat and the boot. Ensure you’re giving your vehicle a regular clear out and, if you’ve got a really long journey, take out everything you don’t need.

The change won’t be huge, but over many, many miles, it can make a big difference. In a similar vein, you’ll want to take off anything that’ll cause more drag when you’re on the move. Not used that bike rack in a few months? Get it off. Less drag, less weight, more savings.

First up, don’t get lost! That’s obviously going to use fuel as you search for the right direction. Admittedly that’s a bit of a given, but go over your route a few times to make sure there’s nothing unexpected.

If you’ve got enough time, follow it on Google Maps so you know exactly what to expect. You could also use ViaMichelin. This route planner is great in general, but it also has the option to select the most efficient route. This means you can find the cheapest way to reach your destination.

Not only is this a safe option, but it’ll save you fuel as well. The faster you go the more fuel you’ll burn, so any temptation to break the limit is not only inviting a crash but it’ll cost you as well.

If possible, let your car roll when you can. If you’re coming up to some traffic lights slow down as early as possible to lower the chances of having to come to a full stop when they’re red.

Your air con is far more efficient at higher speeds, so if you’re driving in an area with lower speed limits, it might be better to just open your windows. When you’re on the motorway, feel free to let rip.

It’s also worth checking everything that’s turned on is necessary. Do you really need the backseat heaters on? What about the headlights when you’re waiting to pick someone up? Have you got time to use a scraper rather than the defroster?

Well, this isn’t an option in all cases, but it’s always worth asking: do I really need to drive?

If you could walk or cycle, that’s going to be the best way to save some fuel. Plus you’ll get some exercise in, which is something many of us miss out on. If not, there’s always the bus or train as well.

You could also look into car sharing too. If you don’t know anyone making the same trip, there’s a bunch of services and apps that connect you with strangers heading your way. There’s a few to choose from, but some of the more popular are Liftshare, GoGarShare, and BlaBlaCar.

Photo credit: Calvin Chou

...